On Thursday June 27th 2021 "Boeing" jumped up in the morning like ten dollars a share and went on to close out the trading session on a strong note. It's not that unusual to see airline stocks jump like this, or "Telsa" or many other stocks priced over $200.00. Stocks like "McDonalds" and "Disney" which cost less by comparison often go up by half of this amount. It's often near impossible to seach out as to why moves like this happen. In this instance, one of the reasons could have being because a Judge imposed a less severe than expected fine on "Boeing" for past issues and another reason was the release of rehashed news about new plane orders. Often times the real issue is trying to determine how fresh all of this news really is.

If your an option player what then do you do when you see price swings like this? Jump in on the upside and hope that this upside wave continues, stay away from it altogether or try to play the downside? If you decide to purchase the next day "Calls" or "Puts" that expire in one day is there a 50:50 chance of winning?. Or are the olds more like a 60% or 70% that you will lose, given the stock might then decide to do nothing? In this particular instance here is some additional news I found. Boeing can move up or down for many reasons.

What now is the above chart we are looking at? Well it's "Boeing's" five day chart and one of the things it shows you is how it dropped in price on Friday' after it's upward spike the day before. Is that what you expected might happen and would you have had the nerve to purchase "Put" options on it on Thursday just before the close?

Stop, I messed. I forgot to build in the excitement of what happened on Thursday morning. Look at how "Boeing" shot up too by 10:00 a.m. and look at where the 252.50 "Calls" were trading at. If the stock is up ten dollars in the first thirty minutes or so of trading why wouldn't it go up even more in price in the next hour or so? Would you have being tempted to purchase the 252.50 series of "Call" options at this particular period of time? They were out-of-the money Calls and it looked like the stock was about to go to the moon.

They were bid 1.82 ask and offered at 1.98 with a high that morning of 2.44 . Look also at how they were traded at a price of only sixteen dollars a contract closer to the opening bell. Someone could have make a nice return on this series of Calls but then again who would be bold enough to be purchasing "Calls" with a striking price ten dollars "out-of-the-money" with only one days trading life to go?

So here is what I did. On the Thursday afternoon I decided to play the downside. At 1:42 p.m. I purchased one "Put" option, the 250 series of "Puts" expiring the next day at a price of$2.00 or two hundred dollars. Then at 1:57 p.m. as "Boeing" moved up slightly I purchased a second contract at $1.68 and then one more again at 1:59 p.m. for 1.69. Now I was into this position at somewhere north of $500.00 U.S. which was the top level of my comfort zone. If I lost it all I wouldn't be in the mood to buy a new tennis racket or new running shoes over the weekend.

What happened next? I had to wait for Friday morning to find out.

The premarket bid and ask shown above shows a bid $246.79, ask $246.97. That was great news. Remember how in a recent blog I talked about premarket trading. What I did was place a premarket ticket in to sell one contract "at market". That's about the only way to trade in the premarkets and hope that they will be fair in the price that they give you. I got a fill at $3.65 and it was reported to me on the opening at 9:30 a.m.

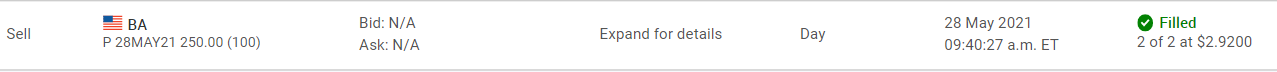

I then hung in for ten minutes after the market opened and sold off the other two remaining contracts at $2.92 each. I just wanted to be out and my profits locked in. What would have happened if I stayed in longer. Here is a look at how this series of "Puts" ended up trading on the day.

They did hit 4.70. Did I buy a new tennis racket or running shoes? No.

Comments