Some seasoned option players don't like playing Boeing Call or Put options that expire that day. Either buying on a dip on the opening or buying in on a Thursday afternoon after 3:45 p.m. When pressed as to why they are of that opinion they sometimes sight other individual airline stocks they like better. Given good news airline stocks priced in the 30.00 or 40.00 dollar price range can go up 50% in a matter of a couple of weeks. Why not just follow a handfull of airline stocks and wait for something good to happen? When you play Boeig options you're at the mercy of countless news releases, each one seemingly more important than the last one. It's a roller coaster game which some traders get tired of playing after they tally up all their wins and losses from doing it at the end of the year.

Playing short term Boeing Calls is not a way to think big. Lumber prices dropped dramatically in the last little while. Did you know that? Big thinkers played it down and made lots of money. Trading Boeing isn't like that. Here is the lumber chart.

Cheers to Boeing opening stronger on the opening. If you are a reader of this site you might remember how I recently traded Boeing in the premarket before the stock opened on a Friday? Will history repeat itself again? Look at what I bought about three minutes before the closing bell yesterday which was a Thursday. I wonder what will happen this Friday morning about 9.5 hours from now? I don't have a feel one way or another. It tanked on the opening on Thursday and it was down on the day. Is it worth it to try and trade such small numbers? Well I made lke $50.00 trading Caterpillar about ten hours ago. Was that worth the effort? I do like swimming in a sea of sharks. I am just a little fish.

I look at it as being a learning experience and its always fun to keep learning.

Here is what the overnight futures market is doing. If you ever going to put yourself in this position maybe the outcome of this experiment might help you calm your nerves in your first attempt at doing something like this.

So here is what happened on friday morning. In option trading things can sometimes go wrong. Late last night I had a scam alert call from the bank saying my account was blocked... someone with my account number was trying an uber eats run. I was instructed to get to the bank in the morning to get a new card, ugh. My Visa card was also hacked a few days earlier and I am waiting 7 to 10 business days for a new one. What this really meant was that I was precluded from trading in the premarkets for technical reasons. I didn't have a valid access code. Others things sometimes go wrong like the Brokers trading platform crashing or a message at 3:57 p.m. when you trying to make a trade asking you to change your password. Here is where Boeing was trading at in the premarkets this morning.

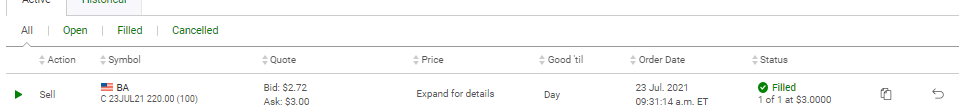

So a trip to the bank and a new bank access card and a fill a minute after the opening bell. I did o.k. but I could have gotten more if I waited another two minutes. I also could have gotten less so I was just happy to be out and on with my day.

Here is how Boing was trading at 9:43 a.m. It did hit $4.70. Oh well, I was in this position for two minutes and twelve seconds on Thursday and one minute and fourteen seconds on Friday so I can't complain.

...... Can you play options on Friday afternoons that expire that day? Not really when the deadline to be out is 3:00 p.m. and not 4 4;00 p.m.? Why? Well in the last half hour of trade you will notice a wider spread in the bid and ask. Here is an example. Can you see the spread of .69 cents. That's crazy. It's a way of shutting down the trading making it near impossible to successfully trade end of the week positions. It's time really to get to the beach.

Comments