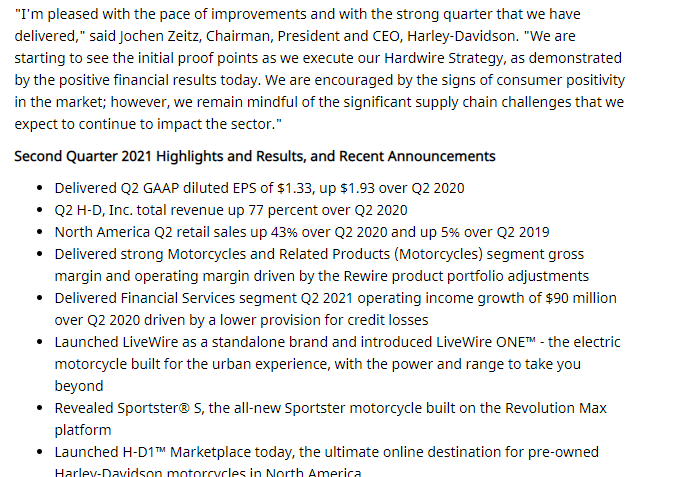

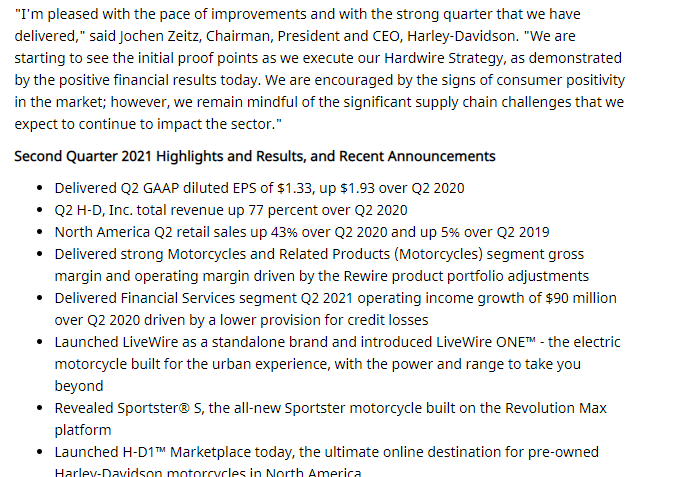

Investors sometimes sell out on good earning reports even if the stock price is not doing well. You be the judge on this one.

Live Wire a new stand alone brand, that sounds good. Options on Harley Davidson are thinly traded and options on stocks in the forty dollar range tend to be difficult to play in the short term range. This could be one of those "legging-a-spread" opportunities I have recently talked about. Purchase a couple of near to the money Call options six or eight months out and sell against them a higher higher series Call options if the stock ever gets a two or three dollar lift. Why are current investors being punished? The covid thing and supply chain issues. Perhaps good times will start to move this stock upwards again. This is a tough one to call with analyst thinking's in recent changing constantly.

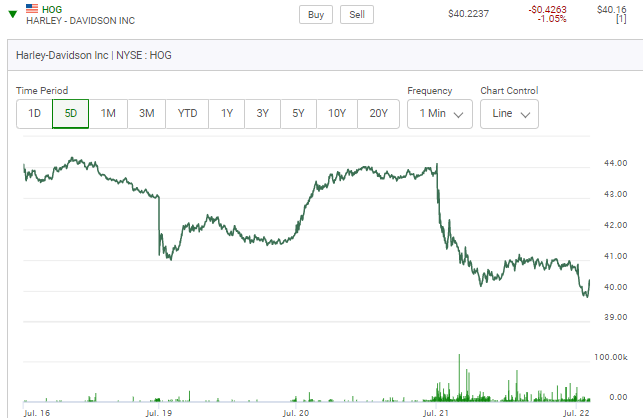

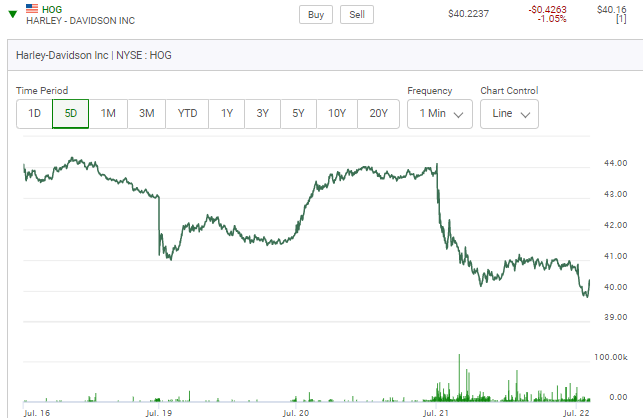

** In this next paragraph I want to discuss the issue with short term option trading on stocks like this that have poor option liquidity. Let's look at the 40 series of Call options on Harley that expire tomorrow. Look at the low volume of trading and the low number of outstanding open interest option contracts.

Compare this to the thousands of option contracts that we know trade daily on stocks like Boeing or Caterpillar. With thinly traded option positions you tend to have to purchase on the ask side and sell on the bid side. Yet that doesn't matter all that much if your timing perspective is many months away.

*** On a differing note the Ford January Calls now look good to me. Dealers don't have many Ford 150 trucks now in stock because of the chip shortage however forward looking thinkers may have reasons to look beyond this.

Comments