The symbol is catchy. This company spends money but doesn't yet make money and is .24 cents a share. I don't own any of these shares. It has a Collingwood Ontario address which should help to perk the interest of potential investors living in that area and a website called www.Limestoneboats.ca. Here is a picture of it's first two boats being hauled away to have motors mounted on them. That recent occurance was cause for a press release, kind of like Rivian celebrating their first truck being driven off the line. Yet things with this boat building company, the Limestone Boat Company Limited are still a bit more under raps and one has to wonder if press releases like this are pushing the envelope when it comes to making "forward looking statements". The boat building industry is not rocket scientist stuff, it's labour intensive and depends for the most part on economies of scale. Starting from scratch is a big undertaking. Get it wrong and the bailiffs will be knocking at your door. The list of casualities is a long one. Investors can be wary of startup companies like this especially if there are setbacks in the startup process. The good news is however that boats are now a hot commodity and the "Limestone" brand name has a bit of a cult following among seasoned boaters. What do you think of the option of being able to go electric? Partnerships are being formed. Do your own research on this one.

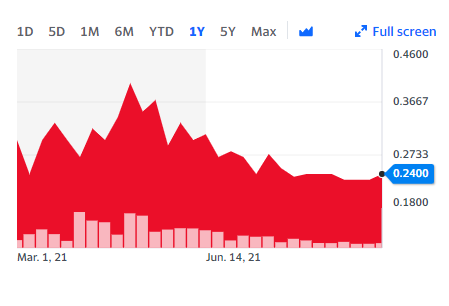

But wait, here is another press release. Before we show you it we want show you a one year chart and say that it's average trading volume is 47,693 shares a day. During some trading sessions there are no trades at all. If do the math that volume of trading of like $11,446 dollars per day. It appears that potential investors are sitting on the fence on this one, watching to see if employees show up to work. The burn rate on capital is yet another issue to consider. I mentioned that a week or so ago when I talked about "Odd Burger".

Visit their website and go the "Sedar" website to learn more. They plan to build 550 boats next year. Cottagers on Lake Joseph will not have to go very far to find a couple of dealers. All of this makes for a good story.

Comments