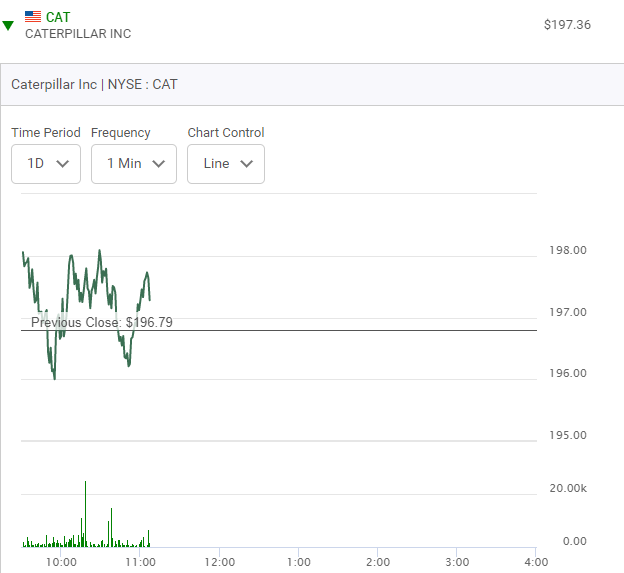

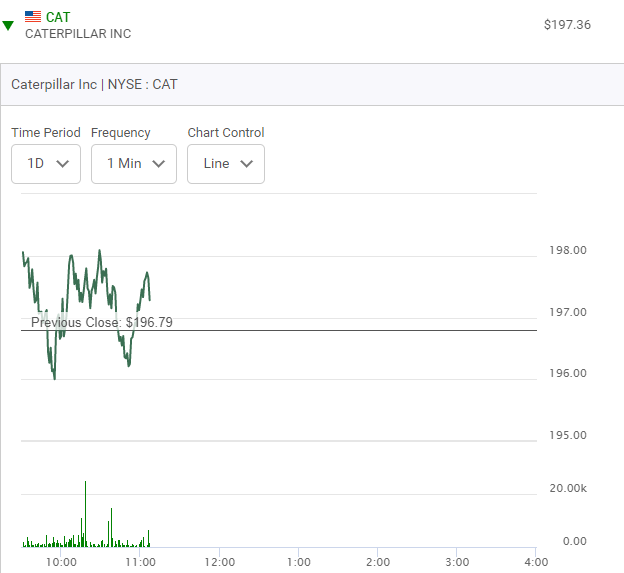

Omicron variant fears. What a week. Boeing down more than ten dollars in one day and then back up that much again the very next day. Why is Friday morning so special to short term options players. It's win or die. Will one of your favorite stocks shoot to the moon? The clock is ticking and with the passage time option prices change. What I want to show you is an example of how quickly things can happen. Here is a chart I saw of Caterpillar on this Friday morning, December 3th, 2021. It's about that time of the day when you start to realize it's abilities to shoot up the 200 dollars mark and over will never happen. To bad for the option traders buying the 205 Calls on Caterpillar on the opening today hoping for a ten dollar price swing.

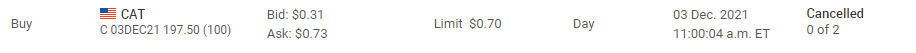

So now look at this, a cancellation of a "buy order" on Catipillar Calls 197.50 Calls at about this particular time. They were the ones going crazy. I changed my bid upwards about three times as it shot up and then gave up. It went from bid .45 -ask- .50 to bid .88 -ask- 1.08 in about three minutes. I gave up after offering .49 on a bid .45 -ask- .50 and increased my bid three or four times up to a bid of .70 .

Now I want you to go back and look at where Caterpillar was at around 10:58 a.m. Can you see how quickly it moved up in price?

I started in the high forties cent range and moved up from there and missed the blastoff. I should have just started "At Market" when it was bid .45 ask .50. I saw that and was watching it all happen. Here is a chart of Caterpillar on the day if you look closely you will see that these Call options, the 175.50 series of Calls then went to trade for over two dollars a contract. Look at the timing of how quickly this all happened.

Was I upset that I missed this action? Not really, a little bit later I went on to make this trade. I was in it for about twenty-two minutes.

Are you now better able to appreciate how this is just the tip of the iceberg as to what happens with "last day" near-to-the-money Calls and Puts options.

* Scroll to the top left and click to see other recent blogs. My last Sugarbud blog is a good read.

Comments