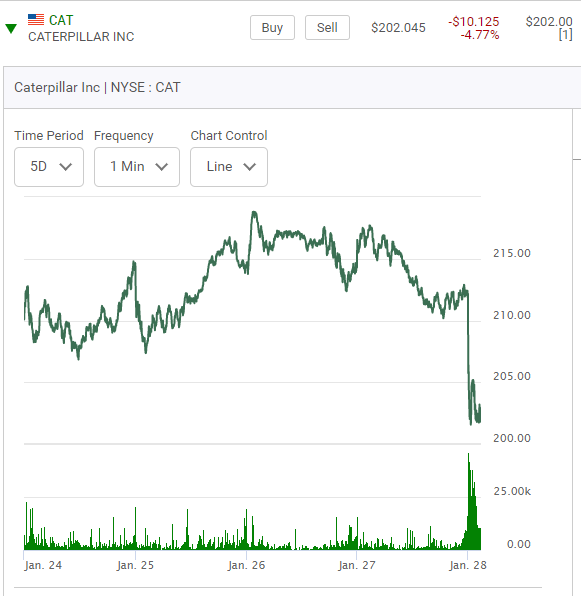

Caterpillar's earnings report. What I see is 4th quarter sales up 23%. Strong 4th quarter earnings of $3.71 per share.That's a solid number. Just think, the supply chain issue isn't being used as a mistake.

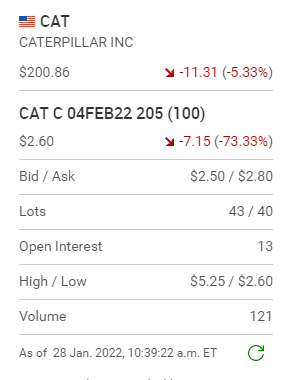

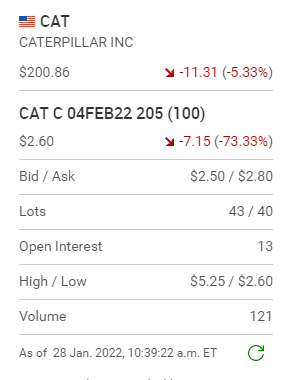

Now look at the the opening options market. The stock is down on the news. Management made a few remarks about near term headwinds. They do that sometimes to temper growth expectations. These two quotes are the 205 Call series which expire today. One is at 9:44 a.m. and one is at 10:03 a.m.. They would be very dangerous to consider purchasing since its very unlikely that they could ever shake off this downward spike so early in the morning.

So now what? It's at this time in the morning when the decision to reacte to this bad news gets tricky. The stock is down like ten dollars and the DJI is having a good day. There is a strong tempation to jump in on the upside hoping for a quick reversal. That's one of the things that makes option trading so difficult. One thing to note is the the daily volume of option trading in the options that expire today day is very low. Other traders are not buying in. What do they know that you don't? Finding a bottom is a bit of a fool's game so it's best to look forward to next week's Call options and take a position which buys you another weeks time. Is one week enough time? Well going longer in time value gets expensive. What you have to keep in mind is that stocks like Boeing and Caterpillar are rising and falling fifteen dollars in one week in recent times. They are both tough to play options on in the short term. Management is offering limited guidance. They have to be respectful of what the numbers are saying and it's easy to make the comments that the next quarter may also be rough but beyond that things should be better. Claims of might might happen in ninety days are of little value now. Why isn't the market excited by the fact that the earnings report beat expectations? The company is now winning contracts to build more electric trains. This could be a 300 hundred dollar plus stock in one years time as could Boeing. Should one now purchase one or five or ten contracts and hope that one week's time is enough time to get a rebound. Fridays are sometimes good days to make entry positions. I got in at 10:42 a.m. which proved itself to be to early as the stock went sideways most of the day. In the afternoon trading nimble traders had the opportunity to catch some short mini afternoon swings. The downward pressure on the stock subsided in the afternoon however there is always the worry that the selling hangover would continue into Monday morning's trading.

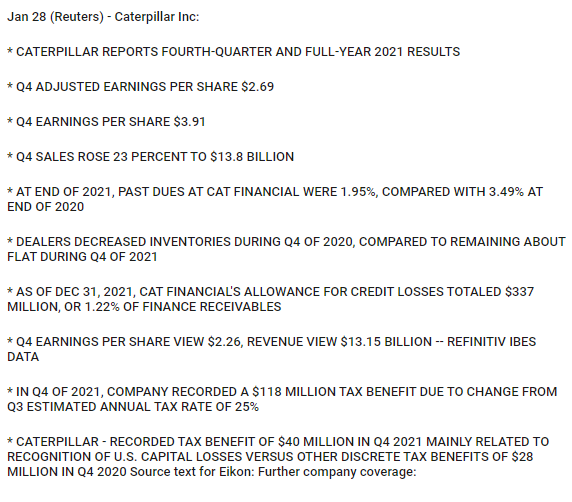

Part two. Just after lunch on Friday look at how Caterpillar refuses to rebound. There is still over three hours of trading time in the market.

With Cat down $13.00 dollars on the day, might a light switch go on and tell people to wake up and reconsider the details in the earnings report. If your interested you could find the conference call online and listen to it and make your own decision. Is it like Tesla, which tanked this week on good earning reports and now is starting to rebound. It's not unusual for good reports to be not quite "good enough".

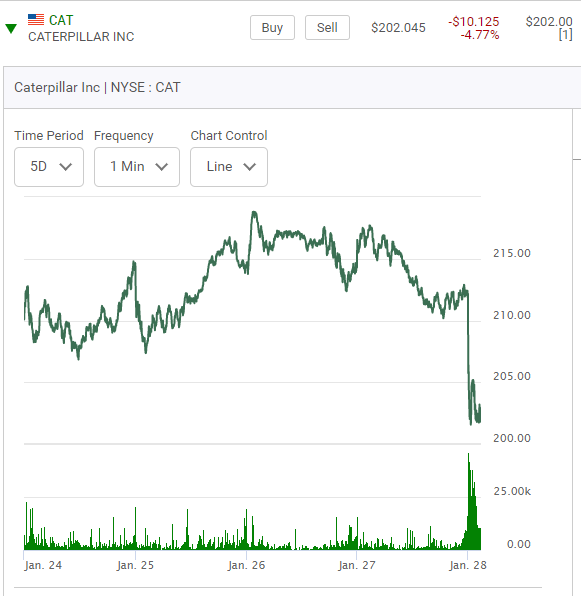

Here now is how Caterpillar closed the day. I now have a week now for it to rebound.

Many traders say that they do not like playing earning reports. In times of covid there ia a slight bias to playing the downside. Look at how Visa and Apple did today on the release of good earning reports. This proves earning reports do matter!

Comments