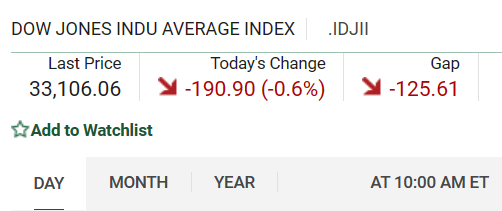

Is Thursday morning a good time to be looking for reversals? Sometimes. Especially when a stock has a recent history of jumping upwards on a Friday morning. This morning, Boeing sold off thirty minutes after the opening bell in sympathy with the DJI selling off 190 points. Yet it was only off a touch while other stocks got hit harder. If the DJI was to ever do a reversal would this be a good time to get in? That was the question early into the trading sesssion and a 190 point drop on the DJI shows less nervousness than lets say a 300 or 400 point morning drop. Watch this.

Now Boeing. Are you able to see it's early morning weakness?

Can you see how Boeing went on to top out somewhere around 1:30 p.m.?

Here is the smallest of all trades.

In at 9:48 a.m. at $52.00 dollars each on two contracts (the 210 Calls) and out at 1:39 p.m. at $145.00. I opted to get out just after the stock crossed over it's previous day's closing. Three points to consider.

1) Read my recent Boeing Call blogs. On Friday Jan 5th I reported that this stock was up $8.01 in one day. This stock is known to have legs.Telsa in recent weeks is much the same.

2) Part of the allure of being in a Thursday morning Call option position compared to a Friday morning Call is the strenght it commands by virtue of still having one additional day of trading power built into it. Yet that allure diminishes with time. Thursday afternoon is generally not a good time to be purchasing Call options on stocks which expire the next day unless you are going so in the final few sections before the closing bell.

3) How did Boeing end out closing the week? Here is it's five day and one day Friday chart. The 210 series I was in ended up expiring worthless.

The real action was in purchasing a 210 Boeing Put on Thursday in the early afternoon and selling it on the opening on Friday morning when Boeing dropped down to the 205 range. I missed that one. **See my Oct 22nd blog about playing Boeing Puts on a Friday morning.

Comments