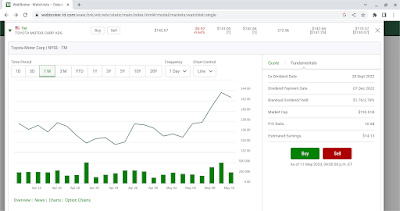

Very few option contracts trade on Toyota. I have wondered why and offer one potential explanation. It's listed on multiple exchanges around the world and "option makers" in North America are basically just following the action. If the markets open stronger in North America that means Toyota traded stronger overnight on markets overseas. Secondly, the Calls and Puts trade in incriments of five dollars.There are for example 135 Calls, 140 Calls, 145 Calls. Having a five dollar spread wipes out the incentive try to daytrade option series which are soon to expire. If the stock moves from 142 to 143 the "bids and asks" on a 140 series of Calls might hardly change. It's not like trading the stock like Boeing where you can get in and out with option series set up in increments of $2.50 . Here is it's one month charts. The company now has a new C.E.O who is getting criticized for not moving to go electric quickly enough. J6KhPh0s8HMgUnhmv/s600/Screenshot%20202...