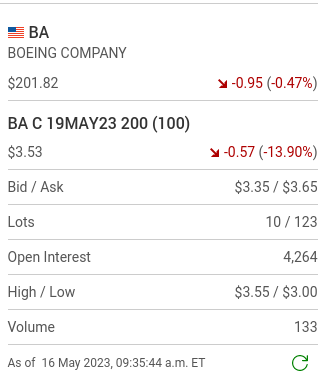

Let's start with Monday May 15th. Here are the two hundred series of Calls that expire on Friday. In the first five minutes of trading 133 contracts sold.

Now here is how it closed the day.

One thing I noticed is that after the first five minutes of trading no other trades were made in this series of Calls. Strange but not crazy strange. Purchasing Call options on a Monday hoping that they will go up in value by the end of the week is usually not a very clever strategy. I have mentioned that repeatly throughout my blogging. Do you notice the volume of trading was very light? Now Tuesday, day two. The markets dropped.

Boeing went up and the markets went down. That can happen. Boeing has a backlong of orders and can't build planes quickly enough. The volume of open contracts went up by 652 contracts, yet 1,865 contracts traded on the day. Some traders where in and out. Having a stock go up on a down day is a bullish sign. Now Wednesday. Boeing jumped up.

Did you notice the open interest dropped? Over half of the volume today were traders closing out their positions. Boeing like Caterpillar and Deere are stocks that sometimes jump. With "in-the-money" options like this just owning one of them is enough to make a profit. Then there was news.

Wednesday was the day that so many things popped.The Boeing pop was a good news in general pop. It was Biden's good news. When Trump was in power he often said things that really made the markets move. Thursday witnessed fewer trades in these "in-the-money" Boeing Calls.

The "open interest" number dropped on the day meaning most traders where in the mode of cashing out and fewer new positions were being opened. The risk-reward ratio of holding onto these Calls is not worth it. Now that we are going into a Friday morning market let's see if the trading volume in let's say the 205 Puts just after the opening increases if Boeing opens a touch stronger. Remember the 207.50 Puts lost over thirty percent of their value today as Boeing stubbornly managed to hold onto it's gains.

If your thinking about playing the downside with one day to go it's high risk. Such a strategy might have more merit just after tomorrows opening if Boeing has a slight morning pop. That's when they could get cheap in price. I wouldn't want to be holding Boeing Calls going into the opening, that's just me. Now a look at Boeing's current five day chart.

It looks like it wants to go higher but there could be some resistance. Watch Boeing next Monday morning and jot down the open interest volume on a series of Calls near to where the stock is trading and do the same thing at the end of the day. Repeat this exercise all week. Learn to teach yourself how day traders play this stock. Monday mornings might prove themselves to not be the best day of the week to be jumping in.

Comments

Post a Comment