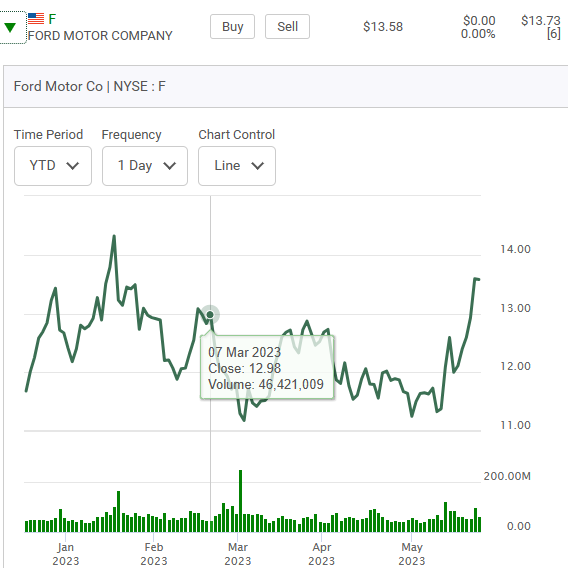

First the year to date chart followed by it's one week chart.

It's Friday morning in the premarkets and which way are the 13.50 series of Calls going to trade on the day? Let's look at how the option traders have set themselves up going into the opening markets. First, let's look at the price on yesterdays closing of the 13.5 Puts and the number of open contracts.

There are 32,193 13.50 Puts outstanding and they cost seven dollars a contract. Ford closed Friday at 13.58 which is eight cents higher that the 13.5 striking price. To break even on these Puts the stock has to close at 13.43. If it closes lower than that your profits start to kick in. The stock is up one dollar in the last few days and it sputtered around yesterday and didn't do anything so it is conceivable it might give up some of it's recent gain. But wait. Imagine the stock opening ten cents lower, let's say it opens at 13.48 on a nervous opening. If that were to happen the Puts would open lower also, probably at around eleven cents. Bingo. If your holding 200 or 300 contracts and if you live in the U.S. and can trade commission free you can jump out on the opening "at market" and go golfing for the rest of the day. The liquidity in the options is excellent and there no monkeying around in giving you a clean fill. Let's now consider what might happen to the 13.50 Calls. Here is how they are set up going into the Friday morning opening bell.

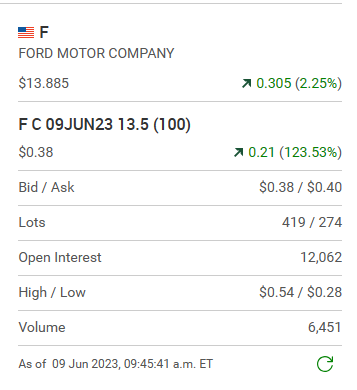

They cost more, seventeen cents to be exact. That's because Ford closed the previous dat at 13.58 so they are already "in-the-money" by eight cents. To break even on the day if you were holding these Calls you bought on the close yesterday at seventeen cents the stock would have to close at 13.63. Might that happen? Note that their are 12,062 of these contracts outstanding which is less than half the number of outstanding Puts. But wait, the Puts only cost about half the price so really the hedging is perfectly balanced. So here we are. It's 8:50 a.m. as I write this. I am drinking my morning coffee. I get it from a company called "Sprockets" in Australia. Let's see if the bulls or bears win. This type of action happens all the time but is extremely revelant on weeks like this when a stock is in an upward surging pattern. Now for a spoiler alert. Fifteen minutes ago when I started writing this blog here is how Ford was trading in the premarkets.

Can you see the "bid" and "ask" is up. It looks like the Call holders at this point in time are the winners. If you put in a ticket now to sell in the premarkets "at market" you will get a decent fill without the need to watch the opening markets. You would have won. Now a 9:46 a.m. update. Look at the Calls

More than a double and the Puts got beat up.

It is interesting stuff but only the tip of the iceburg in what happens in option trading. * See my previous blog on how Ford traded a few days earlier.

Comments