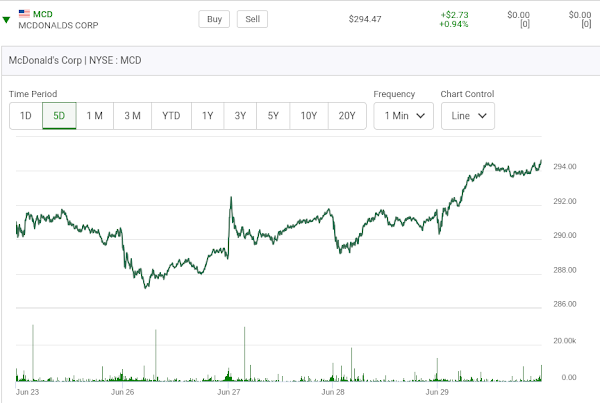

Here is it's five day chart.

Now here are it's "near-to-the-money" Puts and Calls going into the Friday morning opening bell. First the Puts and then the Calls.

So, the open interest is three Puts and nine Calls. If you think about it thats absolutely insane. There is no evidence that existing shareholders are engaging themselves in covered Call writing strategies. There are afterall 730,031,742 shares outstanding. With that number of outstanding shares why aren't there at least 100,000 shareholders using that type of strategy? At the same time the stock is up 6 dollars in 4 trading sessions. Why only nine Calls outstanding going into today, June 30th when the stock in on such a terror to the upside? Here now is the chart at 9:36 a.m., six minutes after the opening bell.

Here are the Calls and Puts at 9:37 a.m.on Friday morning. First the Puts.

And now the Calls.

Now here is where it gets tricky/nasty. The stock is up $1.36 cents and the Call option holders who are taking a huge risk are not being rewarded. The bid and ask has dropped to $1:19-$1:40 from the closing price on Thursday of $185-$1.97. Does that make any sense? Notice somewhere in this morning scramble these Calls traded as low as $.52. What's that all about? Why does it always seem that some traders get in cheap on Friday morning Call action? That is something I will comment on later. It's now 10:11 a.m.? What has happened now? First the Calls and then the Puts. The D.J.I is up about 250 points.

It's a fools game some might say with the stock up $2.23 from the previous days close and with the Call options actually still down from the previous day's close. I agree, except if you were one of the lucky traders who had a premarket ticket in at one third or less of the price of the previous days close and caught some premarket nervousness.

Here is how the day ended.

Putting in premarket tickets at low prices could be the name of the game. I mentioned this also in my June 30th blog when I talked about last day Call options on McDonalds. Buying Call options "at-the-close" on Thursday that expire the next day not so much so.

Comments