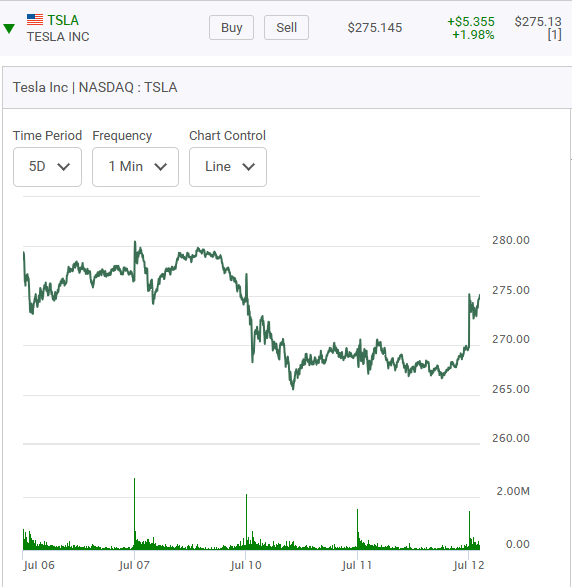

What are the odds on a Wednesday morning of Telsa sitting at $275.00 jumping to $300.00 by Friday of this week? One or two percent at best? I am just picking that number out of a hat. So here is the thing. Short term "out-of-the-money" Calls can be amazing trading vehicles. If you new to the option market for the first time it should not be something that you should be thinking of doing. First todays five day chart on Telsa.

The stock enjoyed a modest opening bounce. Well actually it was one of the best bonces it had in five days. Now look at how the "out-of-the-money" 300 Calls bounced.

Crazy and off-the-wall you might say? In my July 10th blog entitled "A Gamma Squeeze" I provided a statistic which says that Telsa and Apple combined make up 42% of the option trading volume set to expire on any given Friday. (This may not always be the case however it currently is). This tells us two things. First the liquidity is there to make these kinds of trades. Secondly, whether you like it or not this is the new reality of option trading. Illogical, bizarre trading you might say? Maybe, maybe not. It's action like this so many traders are successfully chasing. ** Here now is how these Calls options closed on the next day a Thursday leaving them with only trading day to go. Guess how much they are trading at?

Now here is the lastest action ging into a Friday morning. Look at the volume of Calls traded in this one series. It is a series $1.10 cents "out-of-the-money".

Telsa was uo today. Will the rally carry over into tomorrow's action? Let's wait and see.

Comments