What Can Happen With One Day Options On A Friday when the "DJIA " Jumps 600 Points

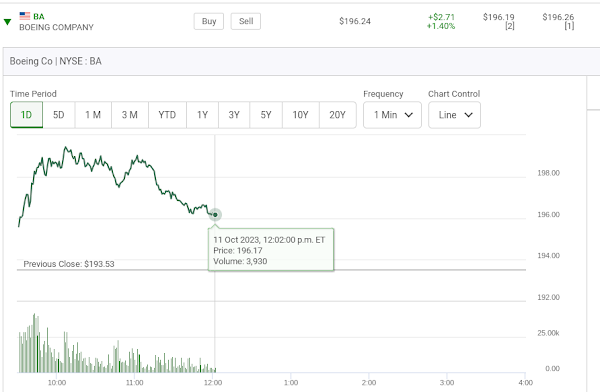

When I sit with my friends on the weekend do I tell them about how Walmart call options traded on the previous day? If I am riding the subway do I talk to the guy next to me about this? Do I tell my boss? My point is, no one cares. People have soceer games to go, cars in getting fixed and all kinds of stresses to deal with. Who wants to watch their computer screens all day trying to outsmart the markets. I get it. Yet if you were good at it, wouldn't this be a fun hobby to have? Now this. A recap of what happened this past Friday. Now a look at one series of Call options with a focus on the high of the day and low on the day contract price. Look at the jump. Now a look at it's one day trading chart. The markets don't usually rally this much on a Friday afternoon. In a way it's a game of being in the right place at the right time. Yet there more to it than that. Knowing what to look for is equally as important. I note that seldom do one day Call options turn out th...

Comments

Post a Comment