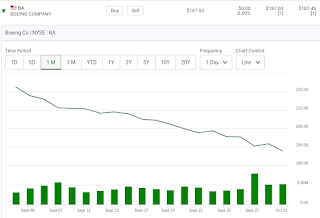

Look at it's 30 day, 5 day and Y.T.D charts. Why does the stock keep falling? The company has a backlog of new orders. Is the company getting so big that it can't manage all of its moving parts? It's so confusing. It's most recent quarterly report was great.

The scary part is that as the stock falls there doesn't seem to be any support levels. That's what makes thinking about trying to play them so difficult. That's why the volume of trading in them is next to zero. Well yesterday it was zero in two series I am watching. Not shown was surge in trading volumes on Boeing in the final few minutes of trade yesterday. In a way that was a tip-off as to the possibilities that the stock might rally on the opening on the following day. Here now are the closing prices of the 187.50 Calls on Boeing that expire this Friday and the following Friday. Remember the numbers $283.00 and $450.00.

Now let's look at how they are trading ten minutes after the opening bell on Oct.3th as the markets opened lower.

The near term Calls jumped from $2.83 to $4.67 and next next week Calls jumped from $450.00 to $620.00. Timing is everything. ** The DJI ended up closing the day down 430.97 points or down 1.29% Here is how the short term Calls we talked about closed the day and a look at Boeing's one day chart.

Writing blogs about Call option trades on down days in the market is not the norm.

Comments