Good morning to the markets on Nov 22nd 2023.

Read the news. Might this stock dip further?

So guess what? Caterpillar dropped in sympathy with this news.

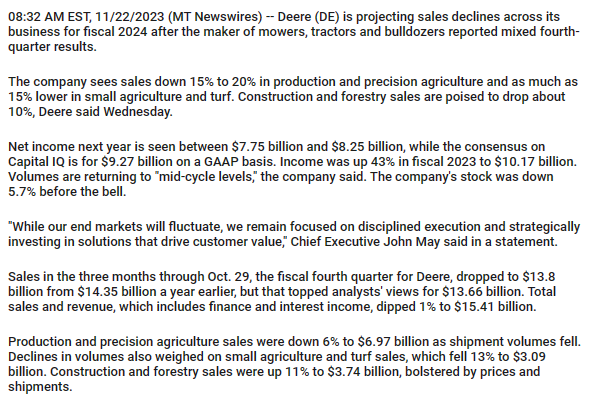

Now what? Income was up 43% in fiscal 2023. That's an amazing accomplishment. Did they upset the apple cart in shouting out their guidance for next year? Their new 2024 projections have a shock value to them and will take some time to digest. But wait, here is a new way to look at it. If the stock starts to go sideways over the next couple of months every tidbit of new news with be an event to celebrate. What a clever way to throw cold water on a hot earning report. PART TWO OF THIS BLOG. What's going to happen to this weeks Call options? Will traders now start to jump back in? Here is how the Call options are now set up. First the Calls with a $360.00 striking price that expire this Friday which is two days away. * the markets are closed Thursday for Thanksgiving.

Now the Calls with a $360.00 striking price one week out.

Check back later to see how this weeks action played itself out. What do you think might happen? Here is what happened. Here are these two Call positions after the market closed on Friday.

Now next weeks Call with the same striking price.

Now here is what Deere did on the week to make this happen.

What now are my thougths? The stock retraced half of it's loss in a day or two. That was expected. Deere is a company not big on news releases. Not many option traders pay options on it because they are expensive. The stock tends to have directional moves which often last for ten, twenty or thirty days. With rising population counts and the continous need for more food this stock is in a comfortable position. The stock dropped on the opening on the day of the release of it's earning report. Thirty minutes into the trading session turned out to be the best time to be buying into it's rebound. It doesn't always happen like this, sometmes it takes more time to shrug off news of any type. It now could be taking a breather so maybe it's best to find something else to watch.

Comments