This blog cost me like $35.00 to post but I am doing it to make a point. In the U.S. you can trade options for free but not in Canada. The example I am about to show you illustrates how Canadian option traders are treated unfairly, to the point of preventing us from trading in one very lucrative segment of the option market. I have talked about this before. To what am I referring? Trading options priced at one dollar to twenty dollars. Here is one example of what I am talking about.

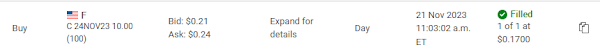

So I bought one Call for $17.00 U.S. plus a hefty commission. What a dumb trade to make. Today is Tuesday and it expires this Friday. On Thursday the markets are closed for Thanksgiving and they are closed half the day on Friday. Time in this position will quickly become a concern. Yet Friday mornings can sometimes suprise. Here is some news that caused it to drop.

Ford frequently has news and here is what the one day chart looks like.

Was it bad news? Not really. They are committed to building a plant in Michigan and the EV news is constantly evolving. The pace of growth is slowing slightly on the EV side but new vehicle sales are up twelve percent year-over-year. So odd are the early morning trading action was a tad of an oversell. Here also is how these Call options ended up trading on the day.

So what is my beef? If I lived in the U.S. I could have purchased 100 contracts for $1,700 and sold them for $2,100 and not lost any sleep and pocketed $400.00. The liquidity and tight spreads are there. In Canada there is a charge of $1.00 per contract in and $1.00 per contract out plus another ten dollars or so in and out or about $220.00 dollars owing in commissions. That's crazy. I could go into a rant as to why the system is set up that way however it wouldn't do any good. Simply put, the Canadian brokerage industry needs massive amounts of upgrading to wake up our capital markets. Letting money flow freely is what ulimately makes the capital markets stronger. Check back in later to see how this scenario plays itself out. Okay. Now for a correction. This blog only cost me $1.25 to post. I got out the next morning at 10:49 a.m.at $.36.

See this chart as for the timing when I got out.

I just wanted to get out to get my money back and prove my point. Boy I wish I could trade without having to pay commisions! A mid Friday morning update, the day these option expire. It would take courage to be still hanging onto these ones. Guess what, a pop on no news.

Playing options on stocks in the ten dollar range is somewhat challenging.

Comments