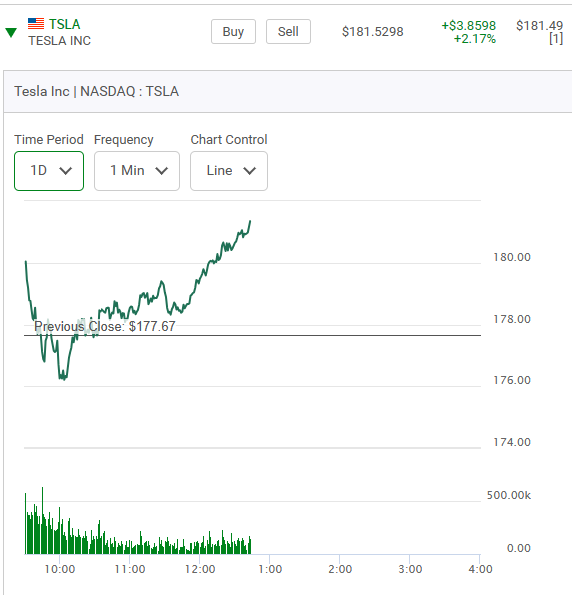

Fight the upside means play the downside. Why would you want to? Well to make money. At 12:47 p.m. on a Wednesday afternoon here is what it's one day chart looks like.

Now of secondary importance is it's five day chart. The D.J.I. is now up 262 points.

The big upwards action on it happened yesterday. Now what? Look at this.

At this particular time this series of Puts gives you relatively good value if

1) you believe the upward move in the D.J.I. might start to level out or start to sell off on the day and

2) if you like the chart formation and once again think a pause in the upward rally is imminent. So do you think you can successfully play Tesla options? In this situation what do you think is going to happen next? Up or down? It's as straightforward a question as that. Forget all of your preconceived notions of what you think is happening in the car industry at the present time. Wednesdays are often days of reversals in the markets. The one hitch is that this Friday is a holiday so the trading week is shortened. Remember in yesterdays blog how we talked of Roku selling off in the last hour of trading? Roku is range bound so that selloff was largely expected. What might happen here in the next hour or so? Here now is what happened in the next thirty five minutes later. Look at how the trading volume has surged into the Puts. Notice also how I was slightly off in my timing. When I was first attracted to the value in these Puts they were trading at $1.37 per contract but they actually then dipped down to $1.09 . The upward movement in the chart formation that I was attracted to had not reached it's top.

Fight the upside means play the downside. Look at how the chart has changed.

That relatively small pull back was enough to make a profitable trade. This is the essense of option day trading. Look at the huge number of contracts traded on a daily basis and this is only one of many series of Call and Put options traded on this stock. Now look at the end of the day closing readings. Over 73,000 options traded in this series of Puts in just the last three hours of trading.

What has now happened is that the stock started to level out and the downward momentum subsided. Next week this action will happen all over again.

*** A March 28th 9:37 a.m. update on the opening. Notice how the open interest is dropping. Today is the last day of trading in this series of Puts. Players bold enough to be holding these overnight were rewarded.

Now a 9:45 a.m. snapshot.

More details to show how trading in this series progressed.

Remember these Put expire today which means option traders must be closing out there positions by 3:00 p.m. Might the stock rebound back up from here? What a gamble. Look at how these two series of Calls are now trading. Look at the high volumes of trading. Suprisingly this is where the action is.

So did these two series of Calls rebound? No.

Finally, how did the 180 Puts turn out just after 3:00 p.m.

It's only recently, thanks in part to the recent strenght in the markets that traders are recognizing the significance of last day option trading. In the past it was something that traders really didn't want to do.

Comments

Post a Comment