Does It Look To You That McDonalds Is Gaining Legs Again?

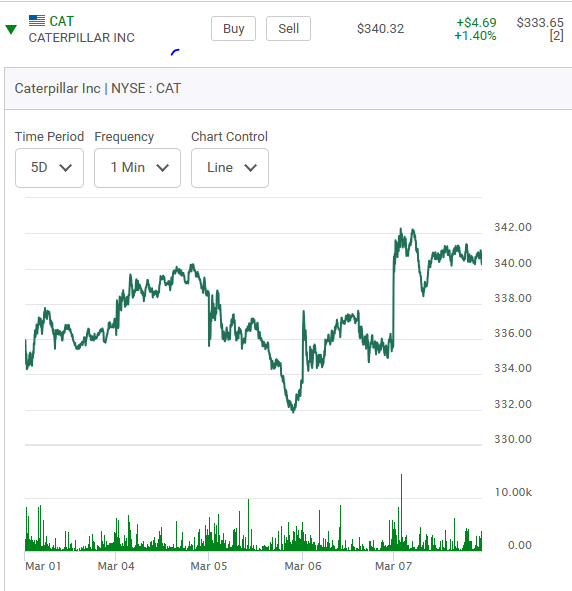

Here is it's three month chart. Let's add some flavour. Let's pull up the details of a April 21st blog I wrote. 2,200 new stores being opened this year, up slightly from the year before. Even if same store sales are now off slightly isn't the projectory still upwards? Their business model still seems to be working. Now this, part of a May 1st 2025 blog. A razor thin adjustments to profits. That's what makes figuring out what is going to happen next so difficult. Now a look at how McDonalds traded on Feb. 6th, 2025. This was the morning after it's quarterly earnings report. Now a look at something more extreme. Let's now go back to a different reality three years ago. The McDonald's story is constantly in a state of evolution. The following snippet might help you realize the power of these quarterly earning reports. Sometimes they are stonger than expected. August 6th will be the date their next earnings report comes out. Here now is how McDonald...

Comments