Might a stock rebound a touch after a $100.00 a share drop in price in only two days? Eli Lilly got hit hard on Wednesday. It got hit again on Thursday as it dropped another $56.69 dollars! Going into the Friday morning session wouldn't you expect a bit of a rebound? Afterall, Eli Lilly has had an impressive run upwards on exceptonal earnings. The stock is solid but has hit some bad news.

In a way this news really just a rehash of old news. Good writers can spin out little articles like this. Take them with a grain of salt. Let's now look at the action in Eli Lilly's most recent five day chart.

Let's focus on how the 850 series of Calls that expire the next day closed out the day on Thursday. That's what most option traders would be focusing on going into Friday mornings trading. They closed at $20.50 per contract which means that the stock would have trade up by $20.15 to the $870.50 mark for the 850 series of Calls just to break even in one day. What a strange situation to be chasing! Note the "open-interest" contract number of only 22. That's nothing. A stock drops over $100.00 in two trading sessions and a $20.00 premium stamped on a $850.00 series option contract keeps everyone away from playing the next day, "one-day" Call options. I get it. So it seems nobody is willing to take that gamble. Do experienced option traders know how to capitalize on an unusual situation such as this? Now consider this. An expert chess player can understand a complex position at a glance, but it takes years to develop that level of ability. Studies of a chess masters have shown that at least 10,000 hours of dedicated practice (about 6 years of playing chess 5 hours a day) are required to attain the highest levels of performance. During those hours of intense concentration, a serious chess player becomes familiar with thousands of configurations, each consisting of an arramgement of related pieces that can threaten or defend each other. Can experieced option traders mimic chess masters? Maybe. Did you read my recent past blog (July 6th) about Deere crashing on a Friday afternoon? What an opportunity that was for seasoned traders. Here are the 850 Calls I talked about at the close on Thursday.

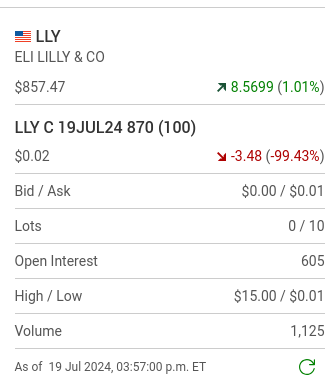

Now here is how they closed out Friday.

The 850 Calls which expired that day did hit an interday high of $27.85 which really not enough of a return for the risk involved. Where was there money to be made? Well in you had cash in your account a safer bet would have being to sell naked the $890 series of Calls at 9:40 a.m. on Friday morning ten minutes into the action when Eli Lilly was up $29.95. These options were expiring that day and one could haved pulled in a premium $237.00 per option contract and then you could have watched them expire worthless! Yet "selling naked" isn't a concept newbie option traders should be exposed to.

Here is what it's Friday chart looked like and you can see it shooting up in the morning to almost $880.00

If the stock didn't take off by 11:00 a.m. and if the markets in general were struggling you would know the stock wasn't going to rebound up to it's previous day's high. This gradual selloff on Friday morning after a brief pop is where the big money could have being made with relatively little pain. Look at how high the following one day Calls traded which later all got wiped out.

Now this. A better strategy. Look at for example the 870 series of Puts and look at their lows of the day which happened in the first thirty minutes of trading as the stock charged upwards. Look at how they traded down to $4.31 a contract. That would have of happened around the 9:45 a.m. period of time. That would of have been the time to buy in, looking for further declines in the stock's price as the day progressed.

This in a way was a "Chess Master" opportunity.

Comments

Post a Comment