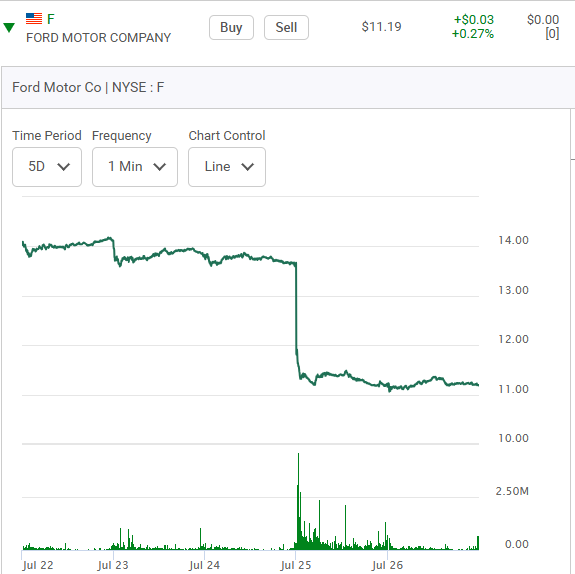

Warranty work costs on older vehicles costs money. We are not talking older-older vehicles but ones that are like two and three years old. Some warranties extend that far out. That's one of the reasons the stock is said to have declined in price. Now look at how the stock traded last week after their second quarter earnings report came out.

Here is what Al Root says about things.

Then there are a host of lawyers now trying to stir up the pot saying that Ford shareholders are getting short changed. They really don't have much of a case. What luck have lawyers had trying to stir up the pot for shareholders of the electric car company called Faraday Future? Not much. If you have the guts to play stocks or options on automobile companies you have to learn how to take the pain.

Tomorrow is going to be another new day and Fords next challenge is to get rid of a whole bunch of excess new inventory. More discounts will have to be offered. The bottom line is that investors got excited about the stock last month for a variety of reasons, only to get beat up. Now might be a good time to buy the January 2026 $11:00 series of Calls and just forget about them for five or six months.

If you want to go even further out here is a look at the $11:82 Jan 2026 Calls. That will buy you a crazy amount of time.

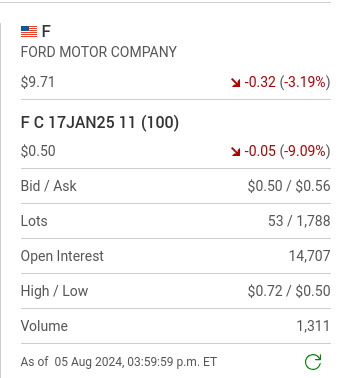

The bottom line is that Ford is not going to go away and their factories are still humming away. ** Now a second look at the January 2025 Calls two days later. Notice the open interest number is starting to go up. Last weeks tumultuous price drop is now history. Or is it?

Now an August 1st update. The D.J.I.A was down over 700 points at one stage of the day.

Now this.

Now Friday morning August 2nd. Another massive hit in the markets. Down 4.5% in earning morning trading. That doesn't happen very often.

These six month out Calls continue to drop.

ding: 1em 0; text-align: center; ">

Now this, Monday August 5th.

I can't tell you what to do but people still like their trucks. Now a August 19th update.

The interest in them is slowly picking up.

Now this, Monday August 5th.

Now this, Monday August 5th.

Comments