An observation. Playing stocks in the under five dollar range is ok if you have time to wait. When it comes to playing options on them you should look to take a two-to-four months out stance. Few option traders play options on stocks in this price range. I do and in these kind of markets as of late the two-to-four month period of time can be shortened up a little. What's sometimes is usefull is to watch three or four stocks in the same sector concurrently to spot a trend. Now look at these charts. They are all in different industries.

Now here is a chart of a stock that was $5.00 like a week ago. What happened and what do they do? They make batteries for Electric vehicles and they just made a deal with V.W. Remember a few weeks back V.W made a deal with Rivean and their stock is jumping up. Now here is another stock doing something a little bit different. They are building a hydrogen/electric powered air taxi with vertical liftoffs and they have recorded a 523 mile flight.

Here is yet another one that is different. "uniQure". It's in the gene therapy sector and they are working on something.

A four dollar stock went to over $10.00. Just think how the options on them did. Here is today's trading action on one series of it's Calls. These Calls are one month out and they had a good jump today. You may however be to late to the party.

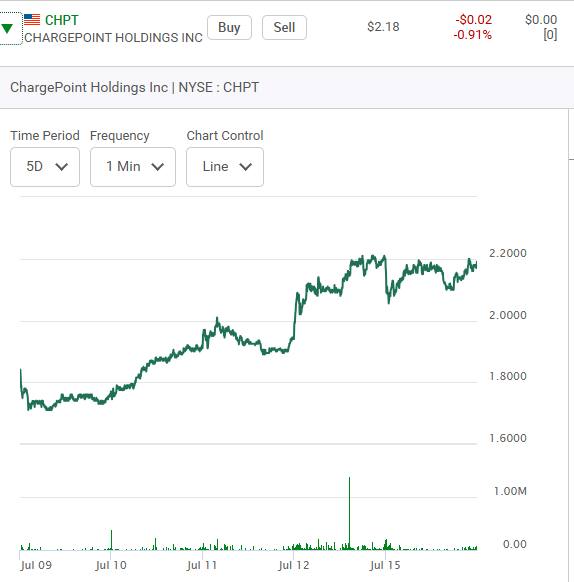

That plus you have to do your own research first. Now back to the concept of kicking the can and looking for stocks in the same sector to help form an opinion of where that sector is going. Here are three stocks under $5.00 per share all making EV charging systems. First, Chargepoint and look at how it has traded in both the last five days and thirty days

.

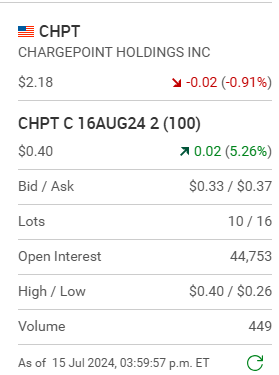

Look at one series of it's Calls one month out.

The second stock in the same sector is Wallbox. Here is it's five and thirty day chart and some news.

The last stock to mention in this same group is Blink. Here is it's five and thirty day charts.

If you follow the E.V. industry you might have more of an insight as to what is happening than I do. All of the options mentioned on all the above stocks are high risk! Better logic might be to just buy the stock. To "feel the pain" of where these stocks are now trading at go back about three years and look at what they were trading for. Many retail players like you and I have got burnt. These are however interesting stocks to bunch together and watch on one of your screens.

Comments