Let's start at noon on Monday August 26th. In previous blogs I have mentioned how low the volume of option playing is on this stock. Why is that? Well one of the reasons is that the company is light on new releases and anyone trying to analyze the company should do so with a longer term prospective. It's not like tracking Boeing which seems to have a thousand moving parts and near daily stories of what just happened the day before. That's why I have sometimes said Deere makes directional thirty day moves and it is easier capital on options that are one month out, rather than one week out. That said, here is it's thirty day chart. August 10th was the time to be getting in on it's Calls. It's path forward now is less clear.

That said, let's now start this blog with its five day chart.

It's flat on the day after being higher on the opening.

........

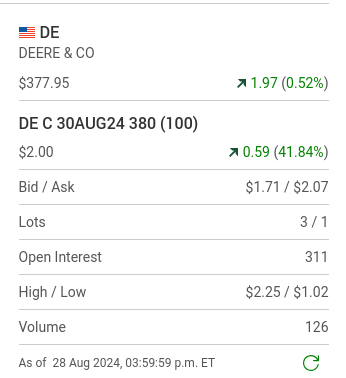

One thought. It could rebound a couple of dollars before the end of the day. Here now is how it closed out the day. The volume of trading on these Calls was next to nothing.

Now this on a Tuesday.

Can you see how suddenly this position lost so much of it's value and might end up expiring worthless on Friday. Three or four or five dollar price swings on this stock happen all the time over two day periods of time. If you get caught going the wrong way can you see how discouraging these options are to play? It's not like playing Tesla options which can swing up or down seven dollars in one day whispering of the silliest of news. That said, Deere options sometimes do suprise. I doubt few other bloggers on the web focus on situations like this. Now the same calls on Wendesday's closing. Down but not out.

Thursday August 29th at the close. Down and not out again. A few lucky traders may have got out at a profit.

Do you think this chart will bounce on the opening? It seems to have a lot of froth and six hours of trading life left in them. Let's see what happens. Here is the Thursday at the close five day chart.

Now to Friday morning, the culmination of a long week of nursing this series of Call options. If you have any of these Calls you would be wise to get out at this point? There are after all easier battles to play. Yet ten again some traders like Fridays action.

Here is how it closed out the week.

Friday turned out to be a week of upward action. Fianally, here is Deere's thirty day chart.

Now it's ninety day chart. It look s like it wants to break out.

All of this to end up just a touch more than it was trading for on Monday. Are you now better able to see why trading thirty day options on this stock is better than ten day options?

Comments