The stakes are huge. Is Deere slipping? Here is it's five day chart.

Could Deere slip to $412.00 on the opening? If it did, could it slip further? The chart looks to me like it wants to open lower. Could you grab some Call options on a weak opening and try to play it for a rebound? Does history repeat itself? Here are how the 417.50 series of Calls traded yesterday on Oct 1st. Can you see how they dipped on the opening and came charging back up? That's the kind of action option traders like to see.

Look at how few contracts trade on a daily basis. Clearly trading Deere options is like skating on thin ice. To add some sort of prespective on todays action here is how the indexes traded today.

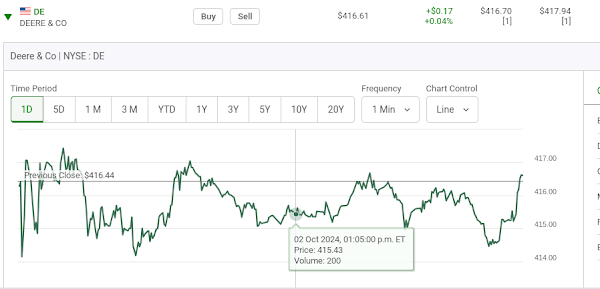

Shown above was Deere's five day chart. Here now is a look at how Deere traded traded today. After a nervous start it showed some strenght in the early afternoon.

Now a premarket look at Deere on Wednesday October 2nd. Look at these four stocks and look at the premarket bids and asks.The time of these premarket readings is not shown but they were about one hour premarket. Deere of the four stocks is the only one that has a wide spread between it's bid and ask. Even Tesla which often swings $5.00 or $10.00 dollars in one day has a tight bid and ask.

Now a quick look at Tesla in the premarkets to illustrate it's premarket swing. On our upper premarket look at prices, Tesla was trading at $256.28-$256.40 and here it is now. It's difficult to read but it's traded down ten dollars.

Did Deere open down. No. It opened flat.Telsa however opened down. It's premarket trading numbers had the stock moving the wrong way. Imagine purchasing a Put on it during the premarkets?

Now back to Deere. So how now are the Deere $417.50 Calls trading at 10:41:26 a.m.? Remember, Wednesdays can be turnaround days.

Here now is what I did. I bought one Call however I gave myself an extra week of time value. It's an Oct 11th $417.50 Call at 11:17 a.m. and I paid $5.00. Why didn't I buy a this weeks soon to be expiring Call that would expire this Friday which was much cheaper to buy? One of the reasons is that the "bid and asks" where to far apart. The option makers were purposely making the short term options difficult to play because of their known volatilty.

If the stock moves up a dollar or two this will be a good vehicle to participate in an upward move. Notice only two contracts on the day.

Here they are seventeen minutes after I got in.

So what happened next? I got out in the last minute of trading in an uptick after the stock dragged it's heals all day.

Look at it's one day chart.

Here is a recap of my trade.

In at 11:17:50 a.m. and out at 3:59:25.p.m. Looking at the strong close was I worried about missing the next day's potential opening rally? Not really. The stock seems to struggle in its attempts to break through the 416.50 level. Now a quick look at the premarkets of Oct 3th and what we observe are weak preopening numbers.

The action is set to begin all over again. **Thursday mornings I find are not favorable to option traders to option trader's looking at options that expire the next day. **** Thursday morning!! Holding Deere options overnight is often an expensive adventure.

Deere closed down the day $7.75.

Comments