Have you noticed in recent trading sessions how five dollar swings in some stocks in one day now seem to be the new norm? First lets look at Caterpillar. Look at all of it's random five dollar daily price swings as of late.

Now look at this, a look at today's action in the $387.50 series of

Caterpillar Calls. Two details scream out at me. Look at how far

apart the "bids and asks" are and secondly, look at how low the "open interest" numbers are. Sure you might get a fill if you split the difference between the "bid" and "ask" but it's going to take a five dollar move in the stocks price, in the correct direction in three trading sessions to cash out with any kind of a profit. It's not out of the question but it is a high risk trade. (It's earnings report comes out Oct. 28th which is to far out to impact the direction of this weeks trading). Using the stock Deere in the next example illustrates this same point. It's earnings report is still over a month away.

Only eleven contracts traded on the day. In other words, traders are reluctant to be buying into these whipsawing stocks. Yet there continues to be plenty of option trading volumes with three trading days to go for both Tesla and Nvidia. First Tesla.

It's rare to see Tesla trade sideways for three days in a row and it's nice to see a tight "bid" and "ask". Look at the volume of Calls on it traded today. The trading volume is huge.

At this stage of the game it is truly a flip of a coin. It's almost a case of buying both a Call and a Put with the hopes of a breakout in either direction. Yet then again it would have to take like almost an eight dollar breakout just to break even. If you follow Tesla you will know that a lot can happen in three trading sessions. Charts like this attract attention. So do pictures like this.

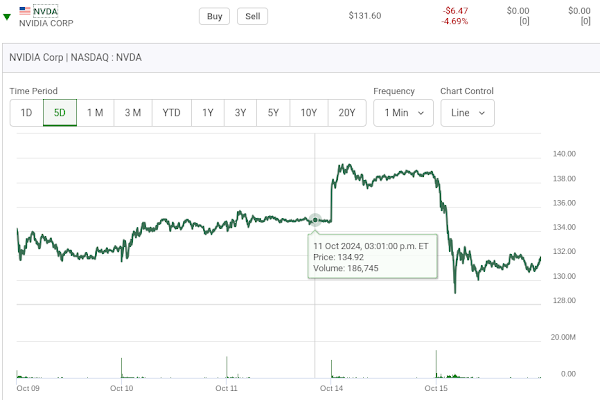

Now look at the current five day chart on Nvidia.

Now here is how the $132.00 series of Call options traded on the day.

The question in this case is this a chart which can rebound? It will be interesting to see tomorrows "open interest" numbers to see how many contracts will still be open on the opening. Option makers, given the large number of open interest contracts have a vested interest in keeping the stocks price below the $132.00 level on Friday's close which is once again three days way. Now here are these options on the opening. A 40% gain.

The open interest number is up showing that traders were moving into this position yesterday. How did these options close today, a Wednesday? The D.J.I.A. was up 337 points. Tesla was up $1.76 and the Calls closed up only a nickel at $3.90 or 1.3%. All of the other three stocks fared better. Deere was up $7.38 and the options we were watching closed at $8.00 or up 100%. Caterpillar was up $7.12 and the options up 78% and Nvidia was up $4.52 and it's options up 95%. As often mentioned, Wednesdays can be turn around days when short term option shine.

Comments