This is my third blog on Walmart in the last six trading sessions. There are reasons why I am shadowing this stock. I mentioned some of the reasons in my past two blogs and the main reason I am shadowing Walmart is that it's the X-mas holiday season and in the last few trading sessions there has being no news out about how holiday sales are going. That's a good thing. In the next week or so thats going to all change. I also note that Costco is down about five percent in the last thirty days so really I am skating on thin ice. Without getting ahead of myself I just want to say it was thin ice skating on this one for a short time today around noon. I will get to that shortly. The truth is that I might compleletely forget about this stock in the next few weeks and move onto something else. It has done me well and it is one that I can comfortably come back to when I feel the timing is right. The markets on Monday morning sold off on the opening so anyone who took the risk of holding Puts on Walmart over the weekend were rewarded. Yet that wasn't something on my radar screen I considered to get involved in. Boeing lost a small plane over the weekend. It was an older one like 30 years old or something. Some smaller airline companies in some far off countries specialize in flying junkers like this. It's part of a business model needed to be profitable. That news helped pull down Boeings share price and the markets a bit. Here now is how the DJIA seems to be rebounding in the mid Monday morning. Rebounds like this however are dangerous because it's still early in the trading session and this is the first trading session of the week. Anything could happen.

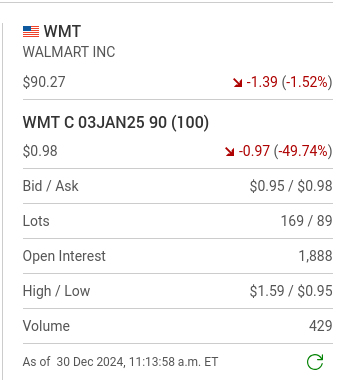

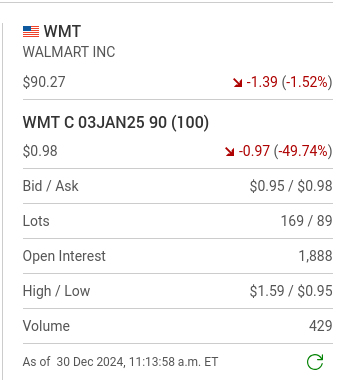

Now a look at the 90 series of Calls that expire on the end of the week. Once agin I did two blogs on Walmart last week. Please read them. One was a Monday morning blog so there are some similiarities in this content. I like Walmart in morning sell off situations like this, looking for a rebound as the stock shadows the movement of the indexes without to much chatter which could send it off in the wrong direction. Now this, you can buy these Calls on Walmart for $.98 cents or ninety-nine dollars a contract and hope this rebound in the markets continues. One might think of it as being an exercise of buying on the dips with the intentions of getting out in an hour or so. If anyone was serious about making a career out of the exercise of buying on the dips they would want to do their research to find when the next big report was coming out on their holiday sales numbers. Or for that matter Costco's numbers. Stay clear of those time periods.

Now this, a look at the same situation a few minutes later.

The stock is up thirty cents. The options are up a touch also.

An incease in the option price from $98.00 to $116.00. On ten contracts that's enough to take a profit and say have a good day. The time period was 29 minutes. Now a look at the markets 27 minutes later which takes us just past noon. Guess what? We are now in a new ballgame. The markets are still down but have come back up about 130 points. It's still down a bunch and it could have another slide. That's the kind of thinking that permeats the markets at this time of the day. Will Walmart get over this hump?

We can see a touch of nerviousness come into Walmart.

So in 37 minutes the options lost .04. If your a short term trader you know how quickly things could go south so there is real temptation at this point in time to call it a day and get out. As a reader what does your gut tell you to do? It's not like time is working against you because the options don't expire until the end of the week. So the adventure continues and the hopes are that no bombs will go off

At 2:25 p.m. the bid is now uo to $1.23 and the ask higher. In at $98.00 and out at $125.00 ish. As a trader who has writen about this stock repeatedly in the last week I would say take the money and pat yourself on the back for discovering a sweet spot in this stocks trading pattern. That's what Monday mornings are all about for those to timid to hold overnight positions. Trading like that is just fine. Now a look at how this option series closed the day. Whatever we discover the closing day options numbers are the person who just recently got at $1.25 is a winner. Here is that reading.

Now here is a five day chart on Walmart.

Daytraders today did have it easy. Mondays are better days that most to speculate on Walmart through the x-mas season. *** How did these options trade the next day, Tuesday December 31st.?

Note the increased number of new positions opened and the lost of one trading day on the week. Any surge on Thursday's opening will cause the Calls to double or more. I am not a big fan of two day options. Let's see what happens. Given that value in these options has dropped from yesterdays levels it doesn't suprise me that the number of open contracts has increased. Past profits made may now be reinvesting. Here also is a five day any one day look at Costco.

On a good day the stock could rally $10.00. Today it dropped $5.94.

These options have had three days of sharp declines on the opening. To be continued.

Comments