What a week for Caterpillar.

Now this. A printout showing how one series of Calls, the $390.00 series traded on Tuesday last week. Thursday was January 23th.

It was up over 313% in one day. If you look at the chart you can see how the stock moved up. Now look at how the same series of Calls closed out the week.

Now notice the small volume of trading in this series of Calls and notice the very small outstanding "open interest" numbers. Caterpillar has over 130,000 employees. It boggles my mind that it's Call options don't have more of a following. I have mentioned this before and many of us know one of the the reason why. Caterpillar never has much gossip to talk about, other than the strike it had last year. Contrast this to let's say a stock like Apple. Apple like Caterpillar has an earnings report coming out this week. What might happen to it is widely reported. Wall Street is bracing for a weak iPhone sales number, especially in China, and a guide down for the quarter.(Earnings per share are however expected to be $167, up 9% on sales of $96 billion, up 6%). Now let's look at what happened the last time Caterpillar had a quarterly earning report. It reported to much inventory in farming and in construction products.

"An ongoing destocking process". That can't be good news. Who is paying the inventory on this equipment? I don't think much has changed in Caterpillars world in this last quarter. Farmers may soon experience rising labour costs if migrate workers are expelled and if construction workers are sent home the demand machinery used to build houses and apartments might slow down. Will the new tariffs hurt it's operations? I don't know. I also don't know the situation with it's manufacturing facilities in Mexico. I am negative on this stock now. Let's look at how Caterpillar traded on the day of the release of it's last earnings report.

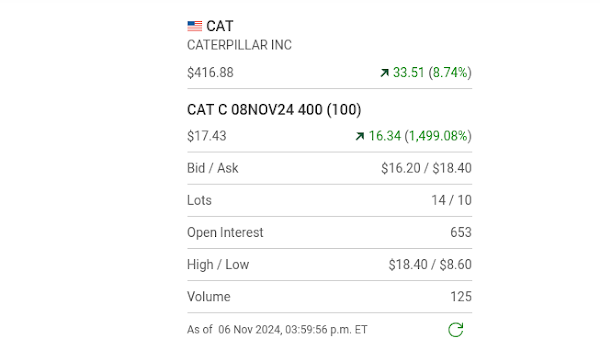

Here we are now. Is Caterpillar now trading at an inflated price? Maybe. It's in a honeymoon mode. Look at how it traded on the day it was announced that Trump had won the election.

Look at how one series of Calls back on Nov 6th reacted to that news.

Now to the present tense. Caterpillar has an earnings announcement coming out this Thursday. Here is it's thirty day chart and a look at it's Call and Put options which expire next Friday. That's the day after it's earning report come out. One strategy would be to purchase both a Call and a Put and hope for a massive move in one direction. It's all interesting however there are easlier battles to play.

I will be watching the option open interest numbers on the opening tomorrow to compare them to Friday morning's open interest numbers. Are traders taking positions in hopes of a Monday morning blip? Maybe. I don't like five day away from expiring options because to much time is wasted on waiting for something to happen. I have more luck daytrading Walmart options. To be continued. Monday morning Jan.27th. Caterpillar was in a bit of a freefall in the early trading.

It's interesting that the Put holders who bought in on Friday are not cashing out right now. Here is how Caterpillar closed out the day.

Here now is how the $407.50 Calls and the $407.50 Puts ended out the day.

The Calls lost over 50% and the Puts went up over 100%. It took nerve to be buying Puts on a Friday with the intentions of holding onto them over the weekend. It did however create a 100% return. To be continued. Todays action with the Nasdaq down over 600 points took some steam out of the markets.

Now this, Caterpillar dropped on the release of it's earning report. First the Calls and then the Puts.

The end.

Comments