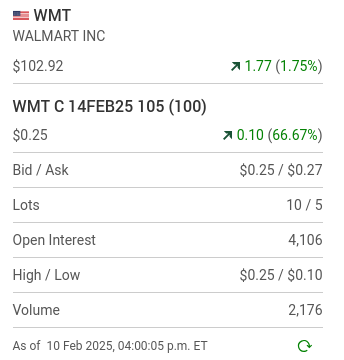

Which are better to speculate in? Well lets pick a stock at at the close on Monday February 10th and look at how the options on it that expire on Friday in four days time have traded on the day. The stock that we will pick will have closed the day on the upside. Let's pick a stock which has options trading on it in one dollar increments. The stock we will be watching is Walmart and the option series we will be watching have striking prices of $101.00, $102.00, $103.00, $104.00 and $105.00 dollars.

What is the purpose of this exercise? Well I want to point out the leverage that different series of Call options have. I also want to mention that the higher "out-of-the-money" options have a higher probability of expiring worthless than "in-the-money" or near to being "in-the-money" Calls. Catch the right directional move on the stock and watch the value of your "out-of-the money" options explode. In contrast, a Call option already "in-the-money" will also see an incease in it's value, but an increase not of the same magnitude. Now a one week and a one day look at the tradings of Walmart.

Now look at how the following four Call series on it traded on the day. The first series of Call options I will be showing are "in-the-money" followed by three series which are progressively "out-of-the-money".

What stands out to me with these numbers? The volume of trading in the Call options with a striking price of $103.00 good until this Friday. The logic is that Call options positions just above the previous day's closing have the most to gain from any upside pop. One of the problems for the existing option holders at this level is that there could be some upside resistance going into tomorow's trading session. This resistance could wipe out some of today's gains. Let's just watch and see what happens next. Now Tuesdays action. Much of Mondays gains were lost.

Are you able to see how the "out-of-the-money" Call options with the higher striking prices took more of a hit that the ones with a lower striking price. The 105 series of Calls now look somewhat vulnerable as they are getting closer to expiring. Maybe its time to say thank you and move on. Now a look at the end of the day readings on Wednesday. Call option holders should be happy.

Comments