McDonald's. It's Difficult To Fight Strong Stocks.

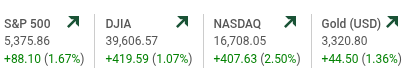

Here is McDonalds five day chart at the close on Wednesday. Now here is it's three month chart. Now consider this. In two days the stock is up about twelve dollars. I often talk about Wednesdays being the one day in the week the markets can do reverals. Today the DJIA was up over four hundred points and McDonalds was down 60 cents. It dipped on the opening and came back a bit and then selling pressure came into the stock again on the closing. I personally hate McDonald's food. The internet has tens of Youtube videos saying their fries are poisonous. Yet I get it. But think about this. Whenever a new residential subdivision goes in anywhere in North America there is room for another one of their restaurants to go in. They just pop up and everyone knows what they are. Here now is a snippet I posted in a past McDonald's blog. After a lackluster trading session today McDonald's could drop in the next two days or at least on a Thursday afternoon sell off. Yet nothing makes sense with Trump trying to do his thing. Here is how the slightly "out-of-the-money" Puts closed out the day that expire in two days, followed by next weeks Puts with the same striking price. Look at how crazy expensive this second series of Puts are. $5.95 for next weeks Puts. That's a crazy high number which reflects the potential volatility of this stock. Buying in on the close today on the Puts would be looking for a home run. But wait, it would also be kind of reckless trade to attempt. Just because something looks cheap doesn't make it a good buy. Taking shots at a company like Tesla which bounces five or ten dollars everyday seems a more sensible trade to make. I like McDonalds for the downside on the next two days but it's to difficult pull the trigger to do it. That plus it's quarterly earning report doesn't come out until May 1st which has the potential to be good. I am going to follow it to see what happens. The charts look like the stock is ready to break out on the upside. But then again a ten dollar pullback is not out of the question. I also know that thursdays are the worst day of the week for having short term (Friday) options shrink in price. I can't play it but I would like to. It's to dangerous to play short term and to expensive to play long term. Let's just watch and see how it turns out. *** A 10:00 a.m. Thursday look. These Puts popped to $3.00 and are showing a wide spread in the new bid and ask. What's going to happen next? Not to get to crazy on details but here is the pain that someone holding these Puts would have to endure at 11:50 a.m. with the Djia up just over 200 points. The trading volume on this series of Puts has increased from the last time we checked on these options but we can't tell if they were new positions opened or existing positions being closed. ***********A 1:15p.m. check in. This is a dangerous time to be in these Puts because the DJIA keeps creeping up. Everything gained in profits could quickly dissipate and the "bid and ask" are purposely crafted to be wide apart. That wasn't the case in the last hour when there was more of a slippery slide downwards. If you want $4.00 here could be your exit point. To be continued. Now around 3:45 p.m. the downward pressure on McDonald's is over and the Puts have lost their power. It was a fun ride but as the day progressed you could tell this downward action couldn't continue forever. Puts options with two days to go are a dangerous animal.

Comments

Post a Comment